skip to main |

skip to sidebar

Last week, the economy appeared to be slowing. But despite the negative economic news, Bonds and home loan rates held steady and were unable to improve further.

Let's look at what happened and what it means...

Housing Starts and Building Permits, which are leading indicators of the new home construction market, both came in below expectations that were already low. If you consider the significant amount of foreclosures and inventory overhang weighing on the market, it is no surprise to see a weak indicator on new home construction.

Broadly speaking, foreclosures and short sales are expected

Housing Starts and Building Permits, which are leading indicators of the new home construction market, both came in below expectations that were already low. If you consider the significant amount of foreclosures and inventory overhang weighing on the market, it is no surprise to see a weak indicator on new home construction.

Broadly speaking, foreclosures and short sales are expected

The labor market and the economy saw their own mixed blessings last week, when three different employment reports were released. Unlike Mignon McLaughlin’s quote above about life, these mixed job reports can actually be untangled. So let’s break down what we learned about employment last week...and, just as importantly, what’s going on with home loan rates.

After two disappointing employment reports earlier last week - in the form of the ADP National Employment Report and the Initial Jobless Claims Report - the labor market finally received some good news on Friday when the Labor Department released their official Jobs Report that showed 244,000 jobs were created in April. That was far above all expectations... and it was the biggest private job increase since 2006!

After two disappointing employment reports earlier last week - in the form of the ADP National Employment Report and the Initial Jobless Claims Report - the labor market finally received some good news on Friday when the Labor Department released their official Jobs Report that showed 244,000 jobs were created in April. That was far above all expectations... and it was the biggest private job increase since 2006!

Just like these lyrics from the "Beasties Boys" song, slow and low have been the tune for the Bond market recently, as we’ve seen our slow economy cause home loan rates to move lower recently. What’s been happening, and where are the economy and rates headed? Read on to learn more.

With the US already facing tough decisions over its national debt, the credit rating firm Standard and Poor's last week cut its credit outlook on the US from stable to negative. Standard & Poor’s also said the US’s AAA credit rating could be cut within two years, if headway isn't made in closing the budget gap. This is important because countries have credit ratings, just like individuals.

But what does all this mean? Let's break it down...

First of all, it’s important to note that the downgrade to the credit outlook was a long time coming, and Traders in the pits even joked that S&P is late to the party with this call. For more information about different countries credit ratings - as well as your own state’s credit ratings - check out this Credit Ratings Link.

All joking aside, this is a serious issue, as the last thing the US wants to endure is an outright credit downgrade. That would make the interest expense on the US debt even more burdensome - and, remember, we are all on the hook for this debt and the carrying costs.

But if this was a long time coming, what sparked the change in outlook? The S&P cited the wide political divide amongst Congress as a major hurdle to meaningfully lower the federal budget deficit. Both parties want to lower the deficit but there is stark disagreement on how to get there. Hopefully, the S&P's actions will spark a fire in Congress to get serious and get something done.

How does this issue impact Bonds and home loan rates?

The national debt concerns won’t be addressed easily, especially when you remember that the country is approaching the debt-ceiling limit on May 16th. So in the immediate future, this will make for more volatility in the markets as headlines gyrate both Stocks and Bonds. Bonds are in an even tougher spot in the long term - and here's why:

First... if the US government is successful in taking action to lower the budget deficit and avoid an outright credit downgrade, then we should expect a longer duration of accommodative Fed monetary policy, as the Fed doesn't want an economic slowdown to recreate a "deflationary" environment. If things do slowdown significantly, we may start hearing debate for a QE3 (or a third round of Quantitative Easing), which would not be good for Bonds and home loan rates.

Second... if the US debt received an outright downgrade, it would be really bad for Bonds. As it stands now, this doesn’t seem likely and you shouldn’t be overly alarmed. But, it’s important to understand what is at stake here. The bottom line is that with some extra belt tightening as a result of this issue, we could expect to see slower economic growth in the future, as government spending would have to slow immensely to help close the budget gap.

But what does all this mean? Let's break it down...

First of all, it’s important to note that the downgrade to the credit outlook was a long time coming, and Traders in the pits even joked that S&P is late to the party with this call. For more information about different countries credit ratings - as well as your own state’s credit ratings - check out this Credit Ratings Link.

All joking aside, this is a serious issue, as the last thing the US wants to endure is an outright credit downgrade. That would make the interest expense on the US debt even more burdensome - and, remember, we are all on the hook for this debt and the carrying costs.

But if this was a long time coming, what sparked the change in outlook? The S&P cited the wide political divide amongst Congress as a major hurdle to meaningfully lower the federal budget deficit. Both parties want to lower the deficit but there is stark disagreement on how to get there. Hopefully, the S&P's actions will spark a fire in Congress to get serious and get something done.

How does this issue impact Bonds and home loan rates?

The national debt concerns won’t be addressed easily, especially when you remember that the country is approaching the debt-ceiling limit on May 16th. So in the immediate future, this will make for more volatility in the markets as headlines gyrate both Stocks and Bonds. Bonds are in an even tougher spot in the long term - and here's why:

First... if the US government is successful in taking action to lower the budget deficit and avoid an outright credit downgrade, then we should expect a longer duration of accommodative Fed monetary policy, as the Fed doesn't want an economic slowdown to recreate a "deflationary" environment. If things do slowdown significantly, we may start hearing debate for a QE3 (or a third round of Quantitative Easing), which would not be good for Bonds and home loan rates.

Second... if the US debt received an outright downgrade, it would be really bad for Bonds. As it stands now, this doesn’t seem likely and you shouldn’t be overly alarmed. But, it’s important to understand what is at stake here. The bottom line is that with some extra belt tightening as a result of this issue, we could expect to see slower economic growth in the future, as government spending would have to slow immensely to help close the budget gap.

Katy Perry’s hit song "Hot N Cold" is all about contradictions. And each week the markets receive their share of news that seems contradictory... but may not be. The inflation reports from last week provide an excellent example - so let’s see what they really said and why it matters!

Last week, two inflation reports came in. The Core Producer Price Index (PPI) reported

Last week, two inflation reports came in. The Core Producer Price Index (PPI) reported

And last week’s Jobs Report offered a few surprises of its own. But were those surprises positive, and what do they mean for home loan rates overall? Read on for details.

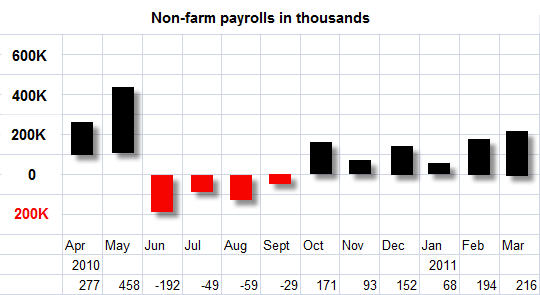

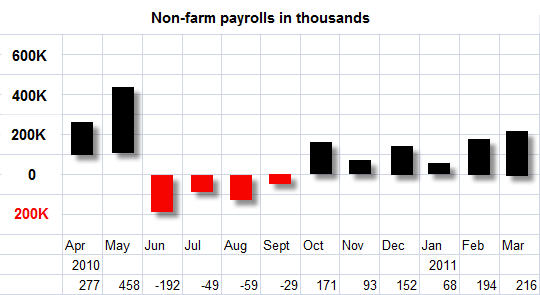

The headline Jobs Report number showed that 216,000 jobs were created in March, which was a positive surprise as this was above expectations.

In addition, 230,000 jobs were created in the private sector, which was also better than expectations and offset a decline in government jobs. A small 2,000 upwards revision to February's prior release added some more jobs as well.

In addition, the Unemployment Rate surprisingly dropped to 8.8%, which is the lowest unemployment rate since March of 2009. Remember, the Unemployment Rate is derived from the Household Survey (exactly as it sounds, from calls made to households), and is considered to be more accurate than the Current Employment Statistics or Business Survey (again as it sounds, from calls made to businesses), which is used to determine the headline jobs number.

The one negative within the report is Hourly Earnings coming in at 0.0%. This is the second month in a row where earnings growth is 0.0%. Why is this significant? If earnings don't grow, people have less to spend and as a forward looking indicator on job growth, it shows that businesses are presently not under any pressure to raise wages. This means they may not have to hire new people as quickly because they may have room to raise wages for present workers down the road.

Overall, the Jobs Report was a good report and reminds us that the trend in the labor market is improving. But keep in mind, while lowering unemployment is good for our economy overall – as are the other two goals (creating inflation and boosting Stock prices) of the Fed’s current Quantitative Easing (QE2) program – these goals can also lead to higher home loan rates over time.

In fact, inflation continues to be a growing concern both around the world and here in the U.S., as several members of the Fed, including St. Louis Fed President James Bullard, have expressed concern that if the Fed waits "too long (to remove accommodative monetary policy) we will get a lot of inflation in the United States and around the world."

What does this mean in the long run? Like the Treasury Department, at some point the Fed will start selling some of its massive holdings and unwind their QE1 and QE2 purchases. And when it does, not only will the Bond market lose a buyer in the Fed, but they will gain a seller and this will make it hard for Mortgage Backed Securities and home loan rates, which are tied to these types of Bonds, to meaningfully improve.

The headline Jobs Report number showed that 216,000 jobs were created in March, which was a positive surprise as this was above expectations.

In addition, 230,000 jobs were created in the private sector, which was also better than expectations and offset a decline in government jobs. A small 2,000 upwards revision to February's prior release added some more jobs as well.

In addition, the Unemployment Rate surprisingly dropped to 8.8%, which is the lowest unemployment rate since March of 2009. Remember, the Unemployment Rate is derived from the Household Survey (exactly as it sounds, from calls made to households), and is considered to be more accurate than the Current Employment Statistics or Business Survey (again as it sounds, from calls made to businesses), which is used to determine the headline jobs number.

The one negative within the report is Hourly Earnings coming in at 0.0%. This is the second month in a row where earnings growth is 0.0%. Why is this significant? If earnings don't grow, people have less to spend and as a forward looking indicator on job growth, it shows that businesses are presently not under any pressure to raise wages. This means they may not have to hire new people as quickly because they may have room to raise wages for present workers down the road.

Overall, the Jobs Report was a good report and reminds us that the trend in the labor market is improving. But keep in mind, while lowering unemployment is good for our economy overall – as are the other two goals (creating inflation and boosting Stock prices) of the Fed’s current Quantitative Easing (QE2) program – these goals can also lead to higher home loan rates over time.

In fact, inflation continues to be a growing concern both around the world and here in the U.S., as several members of the Fed, including St. Louis Fed President James Bullard, have expressed concern that if the Fed waits "too long (to remove accommodative monetary policy) we will get a lot of inflation in the United States and around the world."

What does this mean in the long run? Like the Treasury Department, at some point the Fed will start selling some of its massive holdings and unwind their QE1 and QE2 purchases. And when it does, not only will the Bond market lose a buyer in the Fed, but they will gain a seller and this will make it hard for Mortgage Backed Securities and home loan rates, which are tied to these types of Bonds, to meaningfully improve.

That old adage proved true last week as the fiscal problems in Europe came back to roost as predicted - even after being overshadowed recently by news from Japan and the Middle East.

Despite all the focus on government debt in Europe, it’s important to note that the problems are more than just financial; there is also a ton of political capital at risk. The stronger and more fiscally conservative Euro member countries

Housing Starts and Building Permits, which are leading indicators of the new home construction market, both came in below expectations that were already low. If you consider the significant amount of foreclosures and inventory overhang weighing on the market, it is no surprise to see a weak indicator on new home construction.

Housing Starts and Building Permits, which are leading indicators of the new home construction market, both came in below expectations that were already low. If you consider the significant amount of foreclosures and inventory overhang weighing on the market, it is no surprise to see a weak indicator on new home construction.